wells fargo class action lawsuit uber

The Wells Fargo lawsuit also covers foreign exchange transactions. In 1992 Wells Fargo settled a class action suit for failing to disclose large currency transactions.

District Court for the District of Minnesota.

. Wells Fargo Cuts Overdraft Fees After Settling a Class-Action Lawsuit By Jennifer Farrington. While that number is large this doesnt mean that you should give up hope. The lawsuit was filed just one month after a bombshell report from Bloomberg revealed Wells Fargo denied more than half of Black.

Uber Lawsuit Settlement of Class Action Lawsuit. Uber Class Action Lawsuit 2022 Uber drivers may be entitled to substantial compensation for being misclassified as independent contractors. The person who sued is called the Plaintiff.

If it is found that Uber misclassified you then you could be entitled to backpay for all hours where you didnt earn at least minimum wage on top of tips for all hours worked and you may be entitled to reimbursement for all mileage. The Wells Fargo lawsuit filings follow claims of the bank unfairly repossessing property customers receiving mortgage forbearances they didnt ask for. A 40 million Wells Fargo Merchant Services settlement will benefit certain merchants who contracted with the company for payment processing services.

The Verge covered the story. The proposed settlement was disclosed in filings on Thursday with the US. In addition to filing a class-action lawsuit Wells Fargo is obligated to compensate eligible customers.

Wells Fargo Loan Modification Error Caused By Wells Fargos Negligence. An employee 401K plan from Wells Fargo is the subject of a class action lawsuit filed by a former Wells Fargo employee in the US. The company has been accused of charging small businesses banks and.

13 2022 Published 237 pm. Wells Fargo Wage-and-Hour Lawsuit. Two Classes have been certified in this settlement.

Stay informed and share the love. Kristi BlokhinShutterstock Wells Fargo will pay 500 million to end a class action lawsuit refunding US. Wells Fargo has already paid out certain refunds to.

Fortunately there are a few steps that you can take to increase your chances of receiving a settlement. Wells Fargo Case No. A class action lawsuit alleged Wells Fargo improperly collected the cost of GAP insurance coverage when certain loans were paid off early.

The plaintiff claims that Wells Fargo violated the Employee Retirement Income Security Act ERISA and steered employees investments into its own investment vehicles. Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees. A final approval hearing in the Wells Fargo GAP insurance settlement will be held Nov.

One of the many notorious Wells Fargo lawsuits that made the news were the wage-and-hour violation class-action lawsuits that were filed in California. Your Call is Confidential. More information on Class Periods for the Class and Statutory Subclass is available here.

The 36-page lawsuit filed against Wells Fargo Co. Plaintiffs Aaron Braxton Gia Gray Bryan Brown and Paul Martin all Black homeowners filed the class action lawsuit Apr. The deadline to opt out of or object to the settlement is Oct.

The Class and the Statutory Subclass. District Court in Santa Ana California and requires a judges approval. The lawsuit also alleges that Wells Fargo knew of the error.

Wells Fargo Co will pay customers at least 386 million to settle class-action claims that the bank signed them up for auto insurance they did not want or need when they took out car loans. Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP. 12 in a California federal court alleging violations of state and federal race discrimination laws.

According to the article the attorneys will be representing the nine Wells Fargo employees who have filed a racial discrimination lawsuit. Wells Fargo has already paid out certain refunds to Statutory Subclass members. The Class includes any merchant in the United States who contracted to receive payment.

A class action lawsuit alleged Wells Fargo improperly collected the cost of GAP insurance coverage when certain loans were paid off early. The lawsuit alleges Wells Fargos COBRA notice attempts to scare individuals away from electing COBRA by suggesting that the submission of even incomplete information may result in civil or criminal penalties and that an individuals failure to provide an accurate tax identification number could result in a 50 penalty from the. The settlement agreement provides money for miles driven with Uber and focuses on Ubers deactivation policy.

The Defendant is Wells Fargo Bank NA. Wells Fargo faces a proposed class action in which the bank stands accused of failing to clearly disclose its overdraft practices to accountholders. The article reported that lawyers representing minority employees had filed a discrimination lawsuit against the bank alleging it kept black and Hispanic employees on the payroll longer than white workers.

SAN JOSE CA On July 14 2021 Superior Court of California County of Santa Clara Judge Patricia Lucas granted preliminary approval of a 10536098 class action settlement in Wallace v. The claim form deadline is also Oct. The case is known as Wallace v.

June 10 2021. Call Us Today 202 973-0900 Your Call is Confidential. Lucas of the Superior Court of the State of California in and for the County of Santa Clara is overseeing this case.

The class action lawsuit we filed alleges that Wells Fargo failed to implement and maintain the proper software and protocols to correctly determine whether a mortgage modification was required under federal regulations. The 957 million lawsuit was a combination of two class actions brought by lead plaintiffs Jacqueline Ibarra and James Kang. According to The Verge the Uber settlement agreement is worth 20 million and applies to a class of about 13600 drivers.

And Wells Fargo Bank NA claims the defendants have violated Federal Reserve Regulation E by suggesting that their overdraft policies use an accountholders. In the lawsuit Wallace alleged that Wells Fargo breached its contract with. Let Top Class Actions know when you receive a check in the comments section below or on our Facebook page.

The class size is limited to a maximum of 200000 homeowners. The financial corporation has found itself facing consumer backlash regarding alleged unfair operations of the bank potential unethical practices and more which have resulted in a range of class action lawsuits being filed.

Uber Seattle And U S Chamber End Dispute Over Union Law As City Plans Minimum Wage For Drivers Geekwire

Refuse Service To People In Need 3rd Lawsuit Filed Challenging Federal Mask Mandate Wjla

Uber Imposes Engineer Hiring Freeze As Losses Mount Exclusive

Uber Has An Entire Unit For Following Up On Rides Gone Bad They Say It Leaves Unfit Drivers On The Road The Washington Post

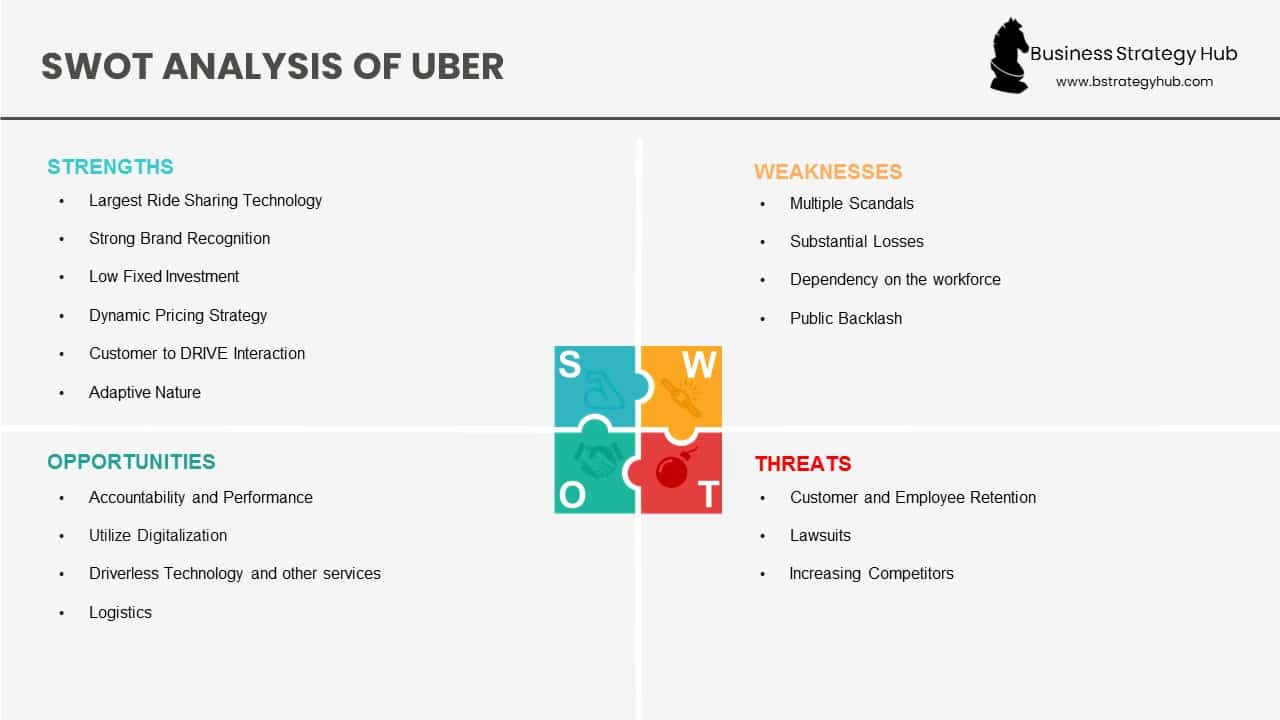

Uber Swot Analysis 2022 Swot Analysis Of Uber Business Strategy Hub

Uber Lyft Add Surcharges To Rides Because Of Higher Gas Prices Npr

What Am I Paying For Uber Fees Explained Fairshake

Uber Ipo Class Action Adds New Claimants Despite Company Protests Top Class Actions

Uber To Pay Washington State Drivers 2 2m In Multistate 148m Settlement Over 2016 Data Breach Geekwire

Uber S Goal Is Not To Operate Alongside Public Transit But To Replace It By Paris Marx The Bold Italic

Uber Request A Ride App Reviews Download Travel App Rankings

Uber Drivers Pay Class Action Lawsuit Tossed Out Of Court Top Class Actions

Uber Class Action Lawsuit Accuses Ride Sharing App Of Overcharging Top Class Actions

Judge Tosses U S Chamber Lawsuit Over Seattle S Uber Union Law But Dispute Isn T Over Yet Geekwire

Common Customer Complaints Against Uber Fairshake

Do You Qualify For Any Of October S Class Action Settlements Moonlighting By Careergig Blog

Uber Sued By Former Worker Seeking At Least 44m On Behalf Of All Washington State Uber Drivers Geekwire

Uber Drivers Given The Green Light On Certain Class Action Lawsuit Claims Top Class Actions